A Focus on Lower Risk While Aligning Values with Investors

The Portfolio Managers of the Hennessy Stance ESG ETF discuss the investment process, recent modifications to the model, and the ETF’s current sector weightings.

-

Bill DavisPortfolio Manager

Bill DavisPortfolio Manager -

Kyle BalkissoonPortfolio Manager

Kyle BalkissoonPortfolio Manager

What is the ETF’s portfolio construction process?

We start with companies in the S&P 500 Index and remove approximately 30 stocks that have exposure to weapons, tobacco, and fossil fuels.

Then we overlay our proprietary ESG (Environmental, Social, and Governance) analysis, which entails ranking, scoring, and weighting the remaining companies against their industry group peers. We consider up to 24 ESG factors in our analysis such as waste profile, water and energy utilization, carbon emissions, labor statistics, compensation, and diversity of board and senior management. The ESG data on the companies is crowdsourced from about 20 different third-party sources that are often issue specific. Based on the results, the bottom 50% of companies are discarded and we continue to analyze the top 50% or approximately 200 stocks.

At the same time, we are performing another analysis based on 20 years of historical financial and market data. This process attempts to predict the top 100 companies that may outperform on a risk-adjusted and total return standpoint. This fundamental model does not look at particular segments of the market; it is only considering the statistically likelihood of outperformance.

The intersection of these two analyses produces our list of ETF holdings that undergo portfolio optimization to minimize tail risk and maximize diversification. We repeat this comprehensive process on a quarterly basis, adding or deleting companies or reweighting stocks based on their relative rank.

Importantly, we are looking for a dispassionate and structured way to invest in ESG companies that is consistently applied over time.

In what investment climate would you expect the ETF to outperform the overall market?

In general, the ETF tends to underperform the S&P 500® Index in a market environment where risk management is not being rewarded. Generally speaking, the companies in the ETF tend to outperform the broad market in a sideways or down market. Over full market cycles, we anticipate that the ETF will outperform the overall market with less volatility.

Have there been any recent modifications made to the model or screens?

Since inception, we have made minor modifications on a regular basis to the machine-learning process and the ESG process. In the first quarter of 2023, we introduced an anti-democracy red flag to remove companies that disproportionately direct campaign contributions to election-denying politicians.

Other minor changes to our machine-learning model include adding new risk metrics, improving forecasting on sales growth, and adding insights to help the model better identify those companies that may outperform with lower risk.

Would you please highlight a new addition or two to the portfolio?

The following are two new holdings we believe play an important role in the transition to cleaner energy sources.

• GE. One-third of global energy generation includes GE technology, and the company has made a commitment to reduce carbon emissions on its products by 2050.

• Trane Technologies, a manufacturing company focused on heating, ventilation, and air conditioning (HVAC) and refrigeration systems, was an early adopter of sustainability. As more efficient HVAC equipment is developed, Trane will likely be a beneficiary.

What changes were made to the portfolio in the first quarter of 2023?

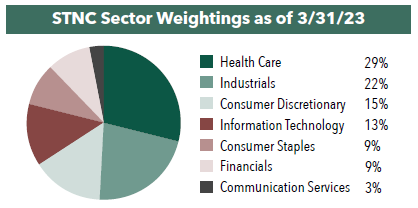

On a quarterly basis, we dynamically adjust sector exposures and individual positions in an effort to manage risk. With that said, the Fund’s weighting in Information Technology stocks decreased from 20% at the end of the year to 13% as of 3/31/23. The largest sector weighting was in Health Care with nine stocks making up 29% of the portfolio, followed by Industrials, which comprised nearly 22% of the portfolio. STNC had no exposure to the Energy, Materials, Real Estate, and Utilities sectors as of 3/31/23.

From a portfolio construction standpoint, the maximum weighting for an individual holding is 3.55% of the portfolio at initial purchase and sector weightings are limited to double the sector weighting of the S&P 500.

- In this article:

- Sustainable ETF