Aligning Investors' Values through ESG Investing

With the increased demand and proliferation of Environmental, Social and Governance (ESG) investments, we believe it is important to evaluate investment choices and participate in a growing trend where Financial Advisors can align investments and values for their clients.

-

Bill DavisPortfolio Manager

Bill DavisPortfolio Manager -

Kyle BalkissoonPortfolio Manager

Kyle BalkissoonPortfolio Manager

Key Takeaways

» A growing number of investors show a pronounced interest for ESG investing, with Millennials representing the best opportunity among generations.

» Educating older investors is important given the great wealth transfer.

» Global ESG assets may surpass $50 trillion in 2025—a 40-plus percentage increase since 2020.

» Values-aligned investing combines a systematic, fundamental research process with companies that resonate with an investor’s ideals.

Growth of ESG Adoption – Millennials Lead the Pack

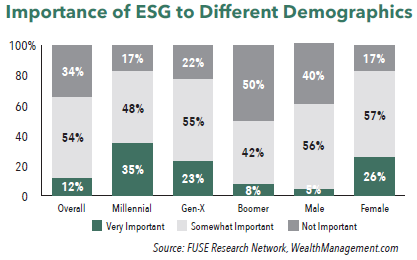

Significant investor groups that represent future growth show a pronounced interest for ESG investing, which today’s Financial Advisors cannot ignore. Millennial investors present the best opportunity for growth of ESG adoption. By gender, females express the strongest interest in the topic. Female decision-makers are an influential and growing segment across generational groups, and their interest in ESG-related topics provides a clear opportunity for engagement.

Importance of ESG to Different Demographics

Older investors, who possess the highest percentage of wealth, show marginal interest in the topic. These older cohorts tend to have a greater focus on protecting assets as they approach or enter the decumulation phase of their investing arc. Though these issues appear to dilute the potential of ESG among older investors, it is possible that ESG investing may provide at least a foundation to solve for these circumstances.

Educating older investors is important given the great wealth transfer that is underway. An estimated $30+ trillion in assets will shift from the older generation to Generation X and Millennials, who are more inclined to consider ESG. As noted, females are a growing segment of decision-makers, and based on longevity data this is likely to intensify, as the life expectancy of American women is five years longer than men. Assets will likely transfer to women prior to passing on to the younger generations.

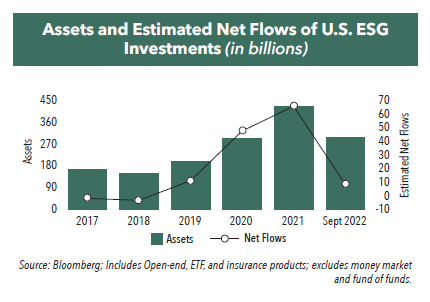

ESG Market Overview: Assets and Net Flows

In January 2022, Bloomberg Intelligence posited that global ESG assets may surpass $50 trillion in 2025, which would reflect a 40-plus percentage increase in assets since 2020. The U.S. intermediary market, reflected in mutual fund and ETF assets, has experienced growth in ESG though at lower rates. While recent headlines and market volatility have tempered flows and enthusiasm regarding the topic of ESG/Sustainability, the long-term prospects and trends clearly provide tailwinds for continued growth.

Where to Invest: The Value in Values-Aligned Investing

Values-aligned investing combines a systematic, fundamental research process with companies that resonate with an investor’s ideals. This approach presents an opportunity to individualize the investment approach in an environment where personalization is being increasingly sought after. In fact, 37% of Advisors believe it is critical or very important to be able to customize solutions to their clients’ ESG preferences, according to a FUSE Research/ WealthManagement.com survey of Advisors.

Importantly, this approach to investing does not supplant the traditional, in-depth investment process applied by active managers; rather, it complements the process with additional elements of criteria and considerations when researching potential companies and constructing portfolios.

Successful application of values-aligned investing requires not only a proven, repeatable research process for sector and security evaluation, but also an integrated method for understanding and analyzing the values-oriented issues and how they may impact or enhance portfolio construction. Simple exclusionary screens, in our view, do not provide for the type of investing being discussed. While some industries may be avoided completely, the application of this approach occurs at the individual security level. This ensures that all opportunities are explored, and then only those that fit the appropriate profile are selected. This process helps to adhere to principals while also focusing on returns.

Risk mitigation is a topic of importance to most investors, regardless of age and wealth. While strong ESG adherence may be an indicator of a less risky investment, a portfolio optimization process to reduce risk is optimal to protect assets for all investors.

Opportunities to Participate

The Hennessy Stance ESG ETF provides an opportunity to invest in an actively managed strategy, utilizing a rules-based methodology, proprietary artificial intelligence (AI) model and portfolio optimization in an effort to minimize risk and maximize diversification.

- In this article:

- Sustainable ETF